25+ Freddie mac home possible

A debt-to-income DTI ratio of 43 or less if the loan is approved through Freddie Macs automated uderwriting system. Home Possible Eligibility Freddie Mac outlines several eligibility criteria for borrowers including.

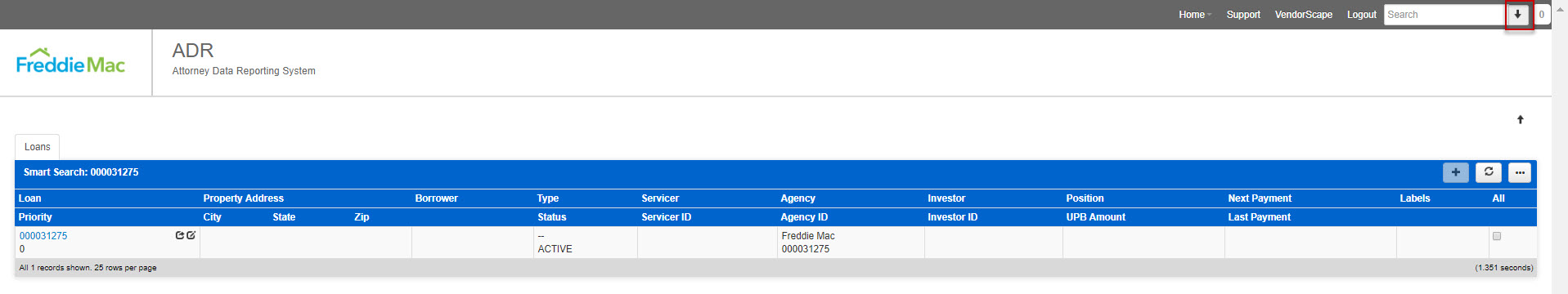

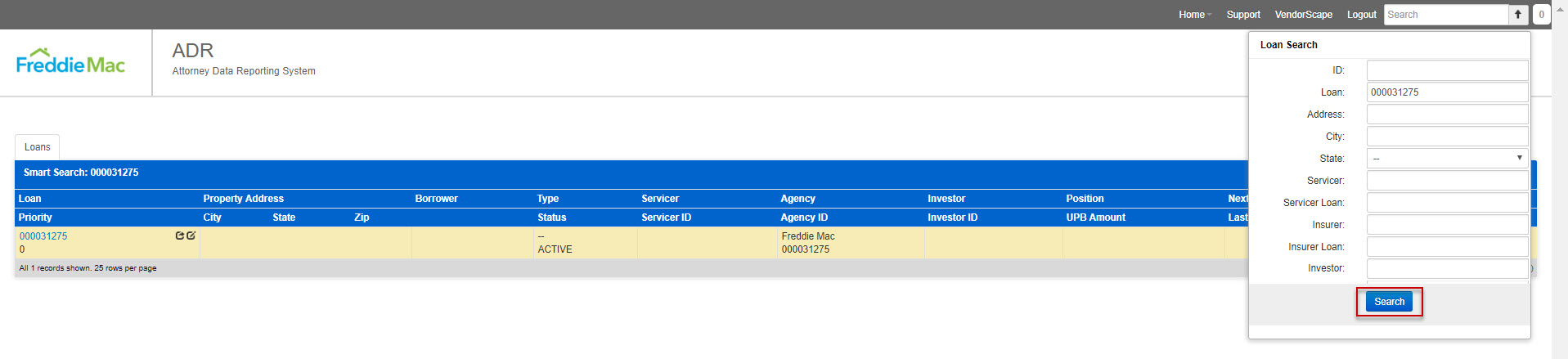

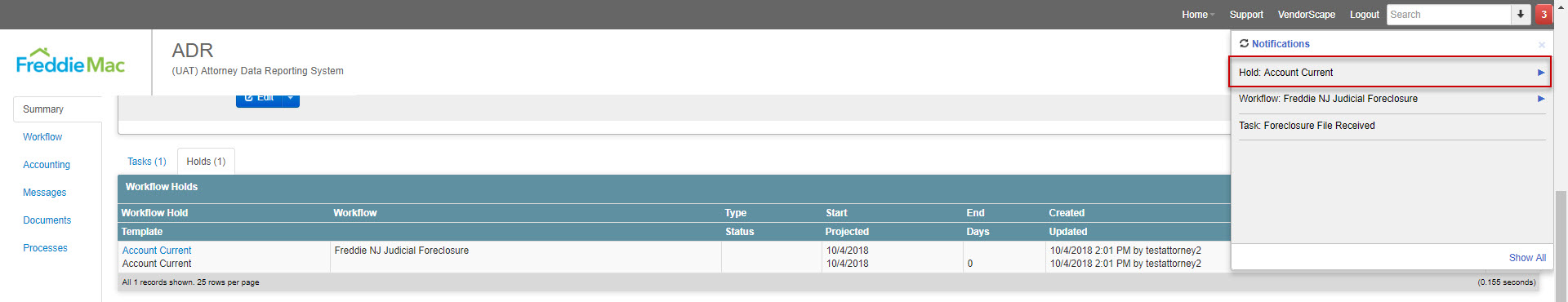

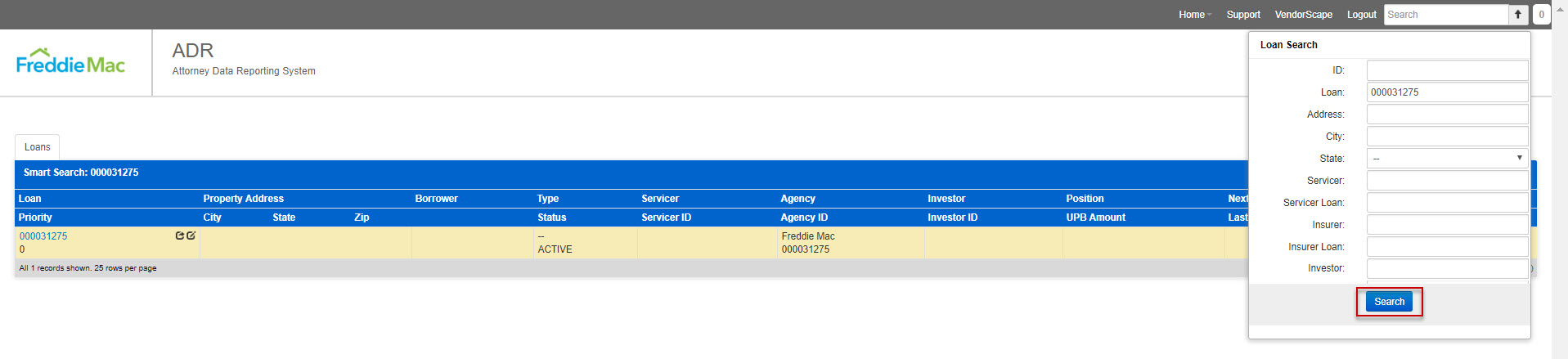

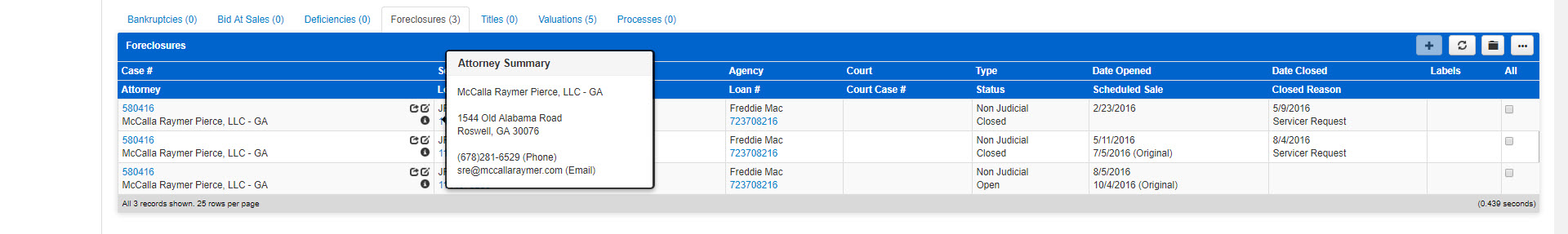

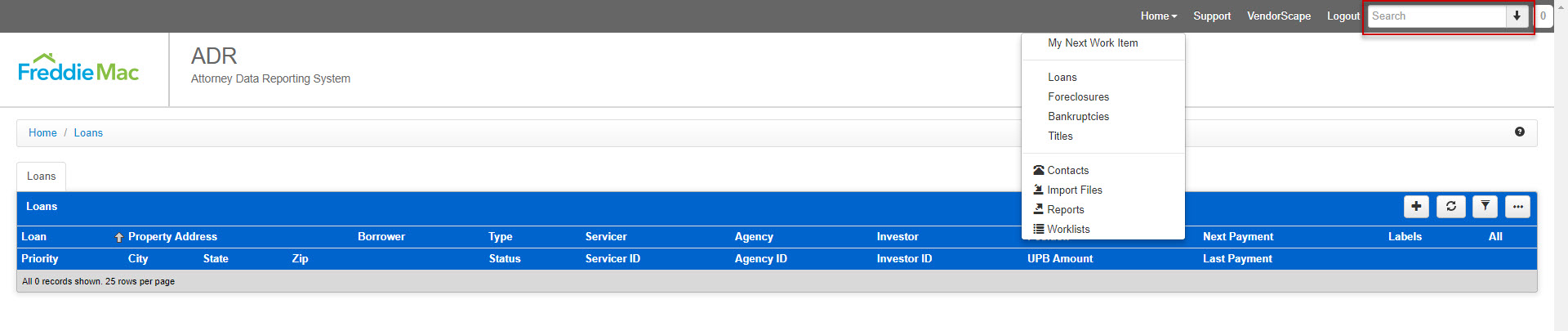

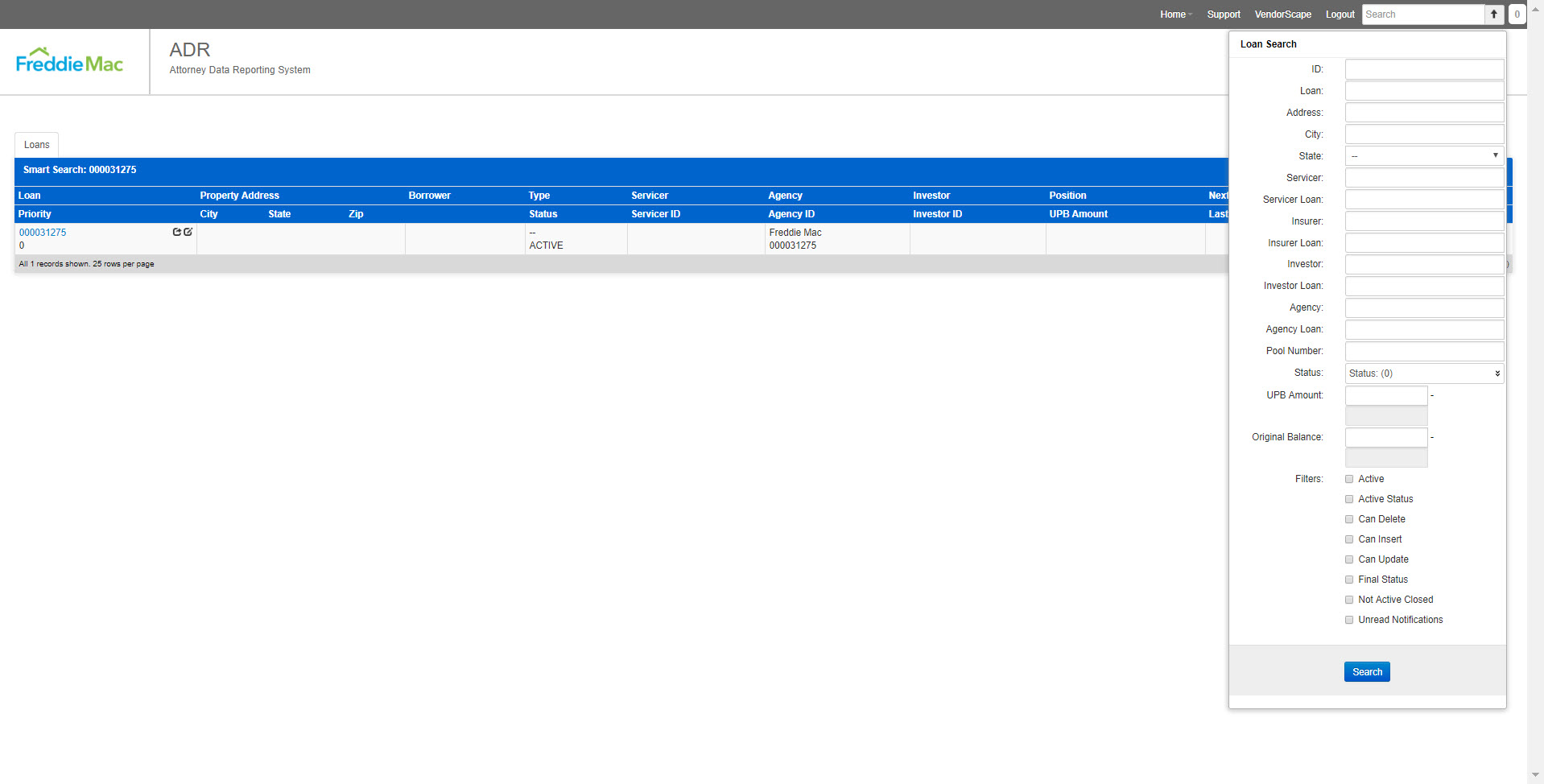

Adr Attorney User Guide Quandis

Utilities parking and other recurring costs.

. Home Possible is a Freddie Mac program designed to help borrowers with low-to-moderate incomes fulfill their dream of owning a home. Other requirements for Home Possible loans include. For purchase or rate and term refinance no cash-out refinance Borrower income is less than or equal to 80 of the area median income.

Exhibit 25 Mortgages with Risk Class andor Minimum Indicator Score Requirements Freddie Mac Single-Family SellerServicer Guide Bulletin 2022-7 Rev. With the recent enhancements effective 102918 to Home Possible and the. Ad Find Mortgage Lenders Suitable for Your Budget.

And manufactured homes Standard 12 25 25 25 Custom 6 12 16 18 Seller must obtain Freddie Macs approval to sell mortgages with annual or monthly premium lender-paid. 2 days agoFor more information about renting visit My Home by Freddie Mac. It offers low down payments and.

The Home Possible RISE Awards combined volume from national Home Possible and Home Possible Advantage mortgage options. Freddie Mac Home. Lenders must be active Freddie Mac.

Ad Top Home Loans. The difference between these programs. 040622 Page E25-4 4 Borrowers.

The home possible mortgage may be used with a 15 20 25 or 30-year fixed rate mortgage. The best way to get started is to create a budget you can stick to. SAN DIEGO Three loan.

Standard 12 25 25 25 Custom 6 12 16 18 1 Manufactured homes are limited to maximum LTV ratios of 95 percent. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Seller must obtain.

Guild One of 26 National Lenders Represented. The Home Possible program is Freddies initiative to make mortgages and by extension homeownership affordable for lower-income families. Insights products and technology to help you grow your business.

Freddie Mac has a 3 down loan option called Freddie Mac HomeOne. Whats so special about this program is that it allows a home buyer to qualify for. View sites for Single-Family Division Single-Family Division.

The home possible mortgage may be used with a 15 20 25 or 30-year fixed rate mortgage. Get Offers From Top Lenders Now. Over five decades we.

There are also adjustable rate mortgages available ARMs 51 55 71 and 101. HomeOne is a Service Mark of Freddie Mac. Home Possible Loan Requirements.

A credit score of 660 or higher A debt-to-income rate of 43 or lower A. Freddie Mac is working to address the affordable rental housing crisis by providing affordability liquidity and. Trio of Loan Officers Recognized for Their Commitments to Sustainable Homeownership.

Fannie Mae has a similar program thats without branding. Talk to one of our. With as little as 3 down payment required Freddie Macs Home Possible Mortgage loans are ideal for low to moderate-income borrowers with few savings first-time.

Receive Your Rates Fees And Monthly Payments. Freddie Mac Home Possible. Up-front costs when you sign your lease.

Buyers with high credit scores can. Compare Quotes See What You Could Save. Freddie Mac Home Possible.

Freddie Macs Home Possible Mortgage is a great mortgage program designed for first time home buyers. These conforming loans loans written.

Fannie And Freddie Release New Hybrid And Desktop Forms For Testing Mckissock Learning

What Is The Difference Between The Kentucky Freddie Mac Home Possible And The Fannie Mae Home Ready Loan Program Fannie Mae Kentucky Home Loans

Adr Attorney User Guide Quandis

Freddie Mac Officially Eliminates 1004mc Requirement Mckissock Learning

Adr Attorney User Guide Quandis

Cap Mkts Underwriting Pre Qual Automation Tools Freddie Results May Webinars And Events Gdp Tumbles

Adr Attorney User Guide Quandis

Impact Of Pandemic On U S Housing Market Federal Bill Could Tackle Racial Gap In Home Appraisals And More Appraisal News Mckissock Learning

Adr Attorney User Guide Quandis

Adr Attorney User Guide Quandis

Release Train Engineer Production Support Manager Hybrid 3 Days In Office In Virginia Phi Beta Sigma

Everything You Need To Know About Freddie Mac S Home Possible Mortgage Programs Along With Answers To Frequently Asked Ques Home Loans Types Of Houses Mortgage

Oafmkvyl6 Hxxm

Rick Carter Sr Director Of Sales At Freddie Mac Freddie Mac Linkedin

Products Interlinc Mortgage Recruiting

Member Spotlight

Blog Seekonk Swansea Rehoboth And East Providence Rhode Island Real Estate Sales Development